News

Unprecedented fluctuations in silver and gold demand and premiums have precious metal distributors trying to navigate a new environment.

BURNSVILLE, Minn., May 20, 2020 /PRNewswire/ -- In recent months, millions have watched as COVID-19 made its way around the world. With it, has come economic instability and unchartered waters for many businesses. The bullion and collectible coin industry has seen extraordinary fluctuations in premiums and demand as buyers and sellers try to navigate a very difficult environment. With supply chains disrupted, shortages have been created on products that were previously plentiful. Industry veterans at Asset Marketing Services have been keeping a close eye on the market during these unprecedented times.

"In the 40 years that I've been working in the precious metals and collectible coin industry, I have never seen a market quite like this one. It's very difficult to compare this time to any other; even the economic crisis of 2008 didn't compare to the surge in demand, premiums, or supply chain disruptions we've seen," said Bill Gale, President and CEO.

In early March, the stock market took a swift downward turn with the onset of COVID-19 in the United States. Many large financial houses such as banks, financial institutions, and individual investors sold their precious metal contracts to cover margin calls. It was this rapid selling that caused the price of metals to plummet with silver falling over 35% in one week alone.

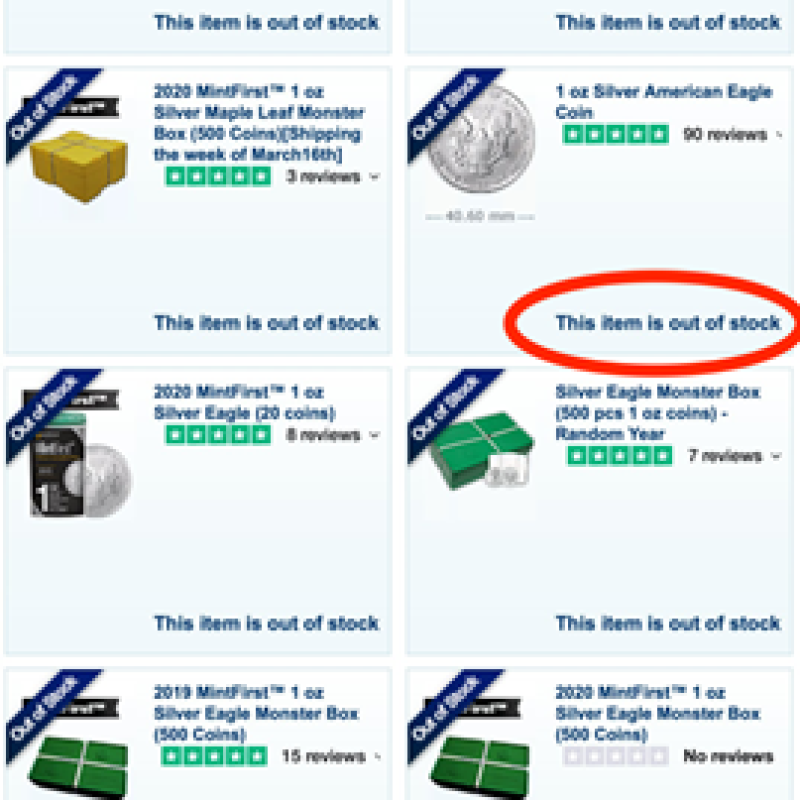

The spot price of silver remained low throughout April, however, increased investor demand paired with disruptions in supply chains due to Mint closures caused a substantial shortage in the availability of collectible coins and bullion. This sudden shortage resulted in many large distributors paying significantly higher premiums for inventory.

"As I sourced bullion products to accommodate the increased demand we experienced from our customers, I found that the shortage was systemic. I couldn't easily source the most common of products, like American Silver and Gold Eagles and Canadian Silver and Gold Maple Leaf coins. When I was able to locate them, they were at much higher premiums," said Barry McCarthy, Precious Metals Buyer.

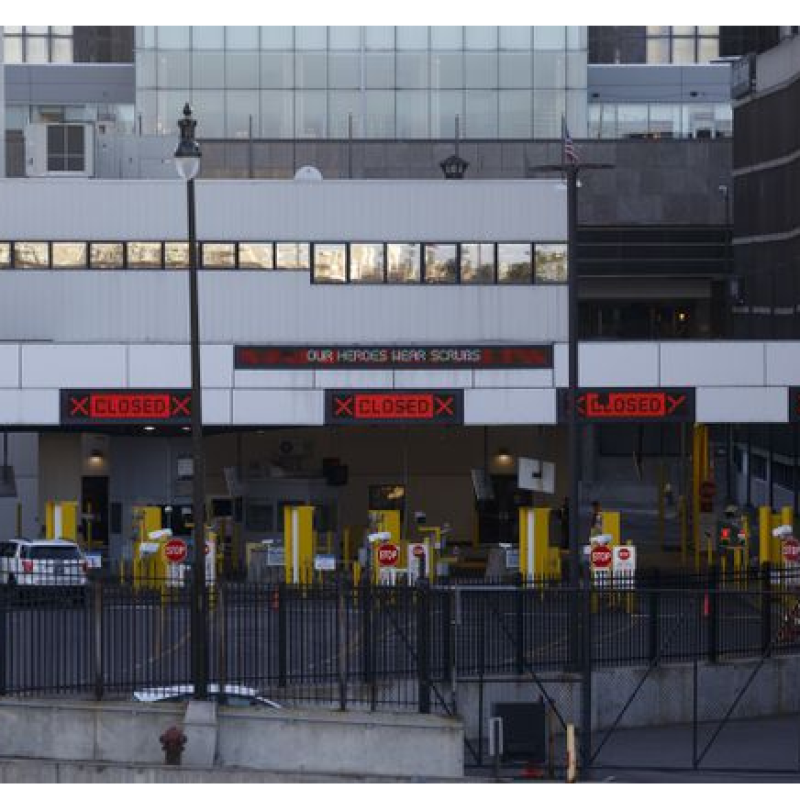

Industry giants, including the United States Mint, are also feeling the effects of COVID-19. In an effort to increase health and safety measures for Mint employees, the production of American Silver Eagles was temporarily shifted to the Philadelphia branch from April 8 to April 20.

In the last few weeks, silver and gold have seen a dramatic turnaround since the COVID-19 impacts began back in mid-March. As seen in the charts, silver and gold both hit their lowest spot prices on March 19 and have since been experiencing a steady increase.

As many investors continue to flock to physical precious metals, the question remains whether the supply will be able to keep up with the demand.

"Although the market is changing every day, our team is closely monitoring spot prices, stock levels, and premiums so that we can continue to provide our customers with the best prices in the industry. Our goal is to ensure our customers are taken care of during this unprecedented time," said Andrew Salzberg, Vice President of Product Development.

ORIGINAL SOURCE: https://finance.yahoo.com/news/covid-19-causes-major-disruption-164500219.html

Pamp Suisse

Pamp Suisse